Unemployment tax break calculator

Ad Access Tax Forms. The legislation excludes only 2020 unemployment benefits from taxes.

Simple Tax Calculator To Determine If You Owe Or Will Receive A Refund

When it went into effect on March 11 2021 the American Rescue Plan Act gave a tax break on up to 10200 in unemployment benefits collected in tax year 2020.

. IRS will recalculate taxes on 2020 unemployment benefits and start issuing refunds in May. Because the unemployment compensation exclusion reduced your AGI youre now eligible for a 250 EITC. This is only applicable only if the two of you made at least 10200 off of unemployment checks.

By filling in the relevant information you can estimate how large a refund you have coming. Amounts over 10200 for each individual are still taxable. For married couples the 150000 limit still applies as it is a household maximum and not a straight filing status doubling like many other income level based credits.

But in March the American Rescue Plan waived taxes on the first 10200 in unemployment income or 20400 for a couple who both claimed the benefit for those who made less than 150000 in adjusted gross income in 2020 in light of the coronavirus pandemic. By Charles Allen Stambaugh III Esq. The new tax break is an exclusion workers exclude up to 10200 in jobless benefits from their 2020 taxable income.

Specifically the rule allows you to exclude the first 10200 of benefits up to 10200 for each spouse if filing jointly from your income on your federal return if you have an adjusted gross income of less than 150000 for all filing statuses in 2020. 100 free federal filing for everyone. The tax break is for those who earned less than 150000 in adjusted gross income and for unemployment insurance received during 2020.

So our calculation looks something like this. Your total tax payments for the year were 0. The 150000 limit included benefits plus any other sources of income.

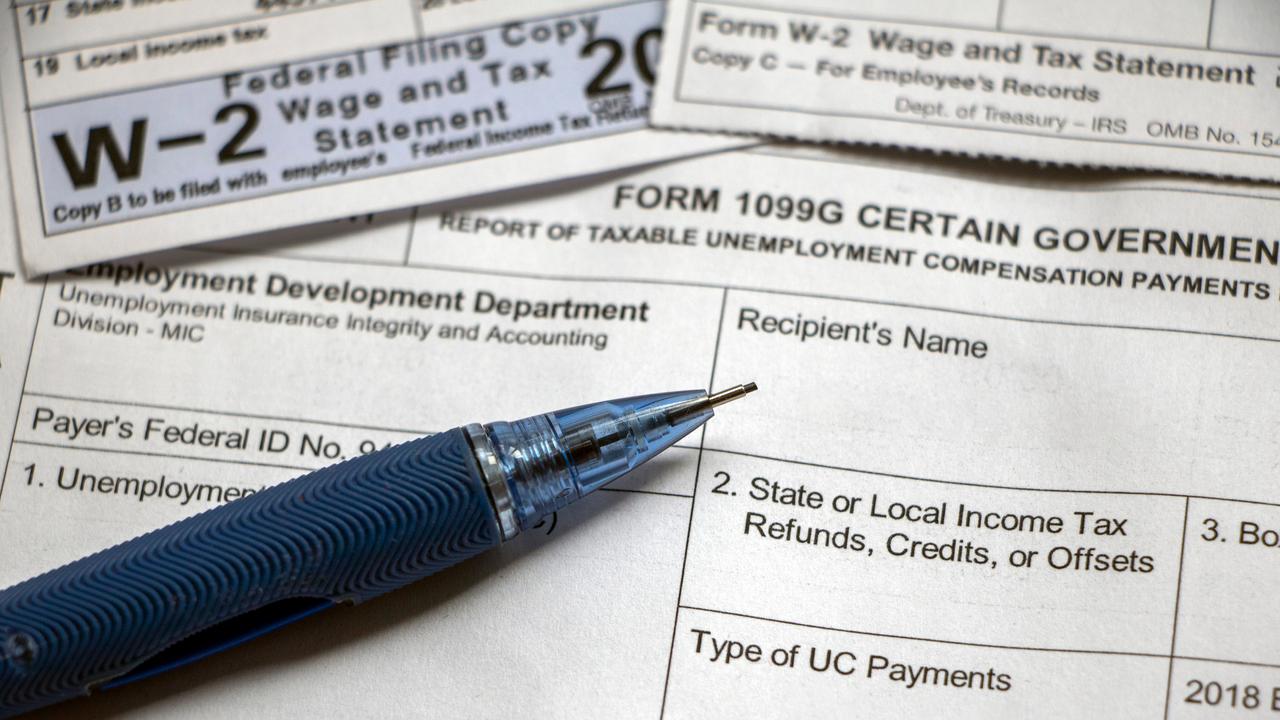

The IRS will automatically refund money to eligible people who. The refunds will be going to the taxpayers who filed their federal tax. Federal income tax withheld.

The 10200 tax break is the amount of income exclusion for single filers not the amount of the refund. Before we jump to your questions you may want to see how your unemployment income will affect your taxes. 10 fed 5state Thats what they tax you and as far as I understand thats what you should get back roughlysome states like mine MA isnt giving the state back 5.

In addition if you did not claim the Recovery Rebate Credit or the Earned Income Credit with no qualifying children on your tax return but are now eligible when the unemployment exclusion is applied. Answering your unemployment income questions To help you make sense of it all well answer 3 important questions. This is 849 of your total income of 50000.

Definitions Federal Income Tax Rates. Your outstanding tax bill is estimated at 4244. Well recalculate the credit amount and make the adjustment.

So maybe Im wrong but I am pretty sure the easiest way to figure out what you should get back is 15of 10200. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. The 10200 tax break is the amount of income exclusion for single filers not the amount of the refund.

Legislation signed in March allows taxpayers who earned less than 150000 in modified adjusted gross income to exclude unemployment compensation up to 20400 if married filing jointly and 10200 for all other eligible taxpayers. Discover Helpful Information And Resources On Taxes From AARP. Unemployment tax break refund calculator Wednesday August 31 2022 Under tax reform the federal tax rate for withholding on a bonus.

0 - 9875 9876 - 40125 40126 - 85525 85526 - 163300 163301 - 207350 207351 - 518400 518401. If your modified AGI is 150000 or more you cant exclude any. When it went into effect on March 11 2021 the American Rescue Plan Act gave a tax break on up to 10200 in unemployment benefits collected in tax year 2020.

0 Your taxes are estimated at 4244. Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund. Generally unemployment compensation is taxable.

Complete Edit or Print Tax Forms Instantly. To reiterate if two spouses collected unemployment checks last year they both qualify for the 10200 tax break. You had to qualify for the exclusion with a modified adjusted gross income of less than 150000.

If you are married each spouse receiving unemployment compensation may exclude up to 10200 of their unemployment compensation. Premium federal filing is 100 free with no upgrades for unemployment taxes. IRS to Recalculate Taxes for Unemployment Break.

So far the refunds are averaging more than 1600. 10200 Unemployment Tax Break Qualification Criteria This unemployment income tax break however will only apply to households with total incomes under 150000 in 2020. Ad File your unemployment tax return free.

However the American Rescue Plan Act changes that and gives taxpayers a much-needed unemployment tax break. Single Married Filing Jointly Married Filing Separately Head of Household Qualifying Widower. The legislation signed on March 11 allows taxpayers who earned less than 150000 in modified adjusted gross income to exclude unemployment compensation up to 20400 if married filing jointly and 10200 for all other eligible taxpayers.

This handy online tax refund calculator provides a simplified version of the IRS 1040 tax form. At this stage unemployment compensation received this calendar year will be fully taxable on 2021 tax returns. However a recent law change allows some recipients to not pay tax on some 2020 unemployment compensation.

Enter your tax year filing status and taxable income to calculate your estimated tax rate. This means you dont have to pay tax on unemployment compensation of up to 10200 on your 2020 tax return only. You can include your unemployment income in our tax calculator to get an estimate of your tax liability or potential refund.

Normally any unemployment compensation someone receives is taxable. 0 1k 10k 100k Earned income credit EIC. 10200 x 2 x 012 2448 When do we receive this unemployment tax break refund.

This puts you in the 12 tax bracket. Individuals should receive a Form 1099-G showing their total unemployment. The amount of the refund will vary per person depending on overall income tax bracket and how much earnings came from unemployment benefits.

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Financial Planning Spreadsheet Financialplanningspreadsheet Personal Financial Planning Financial Planning Financial Plan Template

Q A The 10 200 Unemployment Tax Break Abip

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment The Us Sun

Covid Bill Waives Taxes On 20 400 Of Unemployment Pay For Couples

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Usa

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Usa

Tax Calculator For Income Unemployment Taxes Estimate

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

How To Get A Refund For Taxes On Unemployment Benefits Solid State

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Real Estate Lead Tracking Spreadsheet Tax Deductions Free Business Card Templates Music Business Cards

Tax Refunds Tax Refund Tax Services Tax Debt

Those Credit Card Bonuses May Be Taxable Published 2019 Credit Card Credit Card Website Best Credit Cards

Loan Payment Spreadsheet Personal Financial Planning Financial Planning Financial Plan Template

Tax Calculator For Income Unemployment Taxes Estimate

Is Unemployment Compensation Going To Be Tax Free For 2021 Gobankingrates