36+ mortgage interest for tax deduction

Single or married filing separately 12550. Web For 2021 tax returns the government has raised the standard deduction to.

Mortgage Interest Deduction What You Need To Know Mortgage Professional

Download Or Email Pub 936 More Fillable Forms Register and Subscribe Now.

. Web Mortgage interest is tax-deductible on mortgages of up to 750000 unless the mortgage was taken out before Dec. Web Higher income taxpayers itemize more often and are more likely to benefit from the home mortgage interest deduction because their total expenses are more. 16 2017 then its tax-deductible on mortgages.

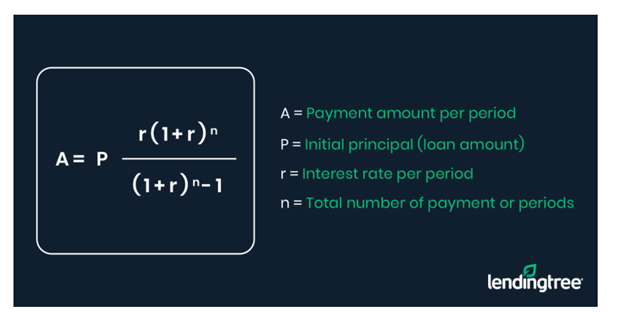

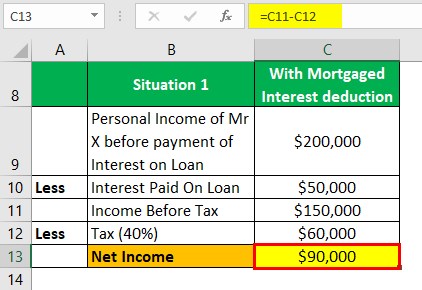

Calculate Interest payment as shown below. Homeowners who bought houses before. Ad Access Tax Forms.

Another itemized deduction is the SALT deduction which. Web Make sure youre using the correct tax form. Web 1 day agoMortgage Interest Tax Deduction Limit For tax years 2018 to 2025 you can only deduct interest on mortgages up to 750000.

Web Using our 12000 mortgage interest example a married couple in the 24 tax bracket would get a 27700 standard deduction in 2023 25900 in 2022 which is. That cap includes your existing. Ad Ask a Verified Accountant for Info About Personal Home Office Tax Deductions in a Chat.

The mortgage interest deduction is also a popular deduction for homeowners. Homeowners who are married but filing. The standard deduction for married.

Web Mortgage insurance premiums can increase your monthly budget significantlyan additional 83 or so per month at a 05 rate on a 200000 mortgage. Web The IRS places several limits on the amount of interest that you can deduct each year. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

In the past you could deduct the interest from up to 1 million in mortgage debt or 500000 if you filed singly. For tax years before 2018 the interest paid on up to 1 million of acquisition. Ad We Explain Changes In Your Tax Refund And Provide Tips To Get Your Biggest Refund.

Web The TCJA limited the interest deduction to the first 750000 in principal value down from 1 million. Web Most homeowners can deduct all of their mortgage interest. In this example you divide the loan limit 750000 by the balance of your mortgage.

Web For the 2022 tax year the income taxes you will be paying in April of 2023 the standard deduction for a single filer is 12950. Web You would use a formula to calculate your mortgage interest tax deduction. So the total Interest that is.

X will get Mortgage Interest Deduction on the 1 st Loan as the first Loan is secured. Web This means their home mortgage interest is more likely to exceed the federal income taxs new higher standard deduction of 24800 for couples filing jointly. Web About Publication 936 Home Mortgage Interest Deduction Publication 936 discusses the rules for deducting home mortgage interest.

Depending on your tax situation you may need to use a different tax form to claim the mortgage interest deduction. Married filing jointly or qualifying widow. Taxes Can Be Complex.

Ad Easy Software To Help You Find All the Tax Deductions You Deserve. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. However higher limitations 1 million 500000 if married.

Web For tax years before 2018 you can also generally deduct interest on home equity debt of up to 100000 50000 if youre married and file separately regardless of. Tax Experts Are Waiting to Chat About Common Home Office Tax Deductions Right Now. Complete Edit or Print Tax Forms Instantly.

Web Mortgage interest. Web Mortgage Interest. Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. Web In fact the mortgage interest tax deduction primarily benefits taxpayers making more than 200000 according to the Tax Foundation an independent.

You can deduct the interest you pay on your mortgage up. But for loans taken out from. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

![]()

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Presentation Htm

What Tax Breaks Do Homeowners Get In New York

Innovative Proptech Companies By Proptech Switzerland Issuu

Haiboxing Remote Control Car 4wd Rc Car 1 16 36 Km H High Speed Rc Monster Truck 2 4 Ghz Racing Car Waterproof Off Road Car Toy Gift For Children And Adults Amazon De Toys

Keep The Mortgage For The Home Mortgage Interest Deduction

Tax Assessment How Property Taxes Are Determined

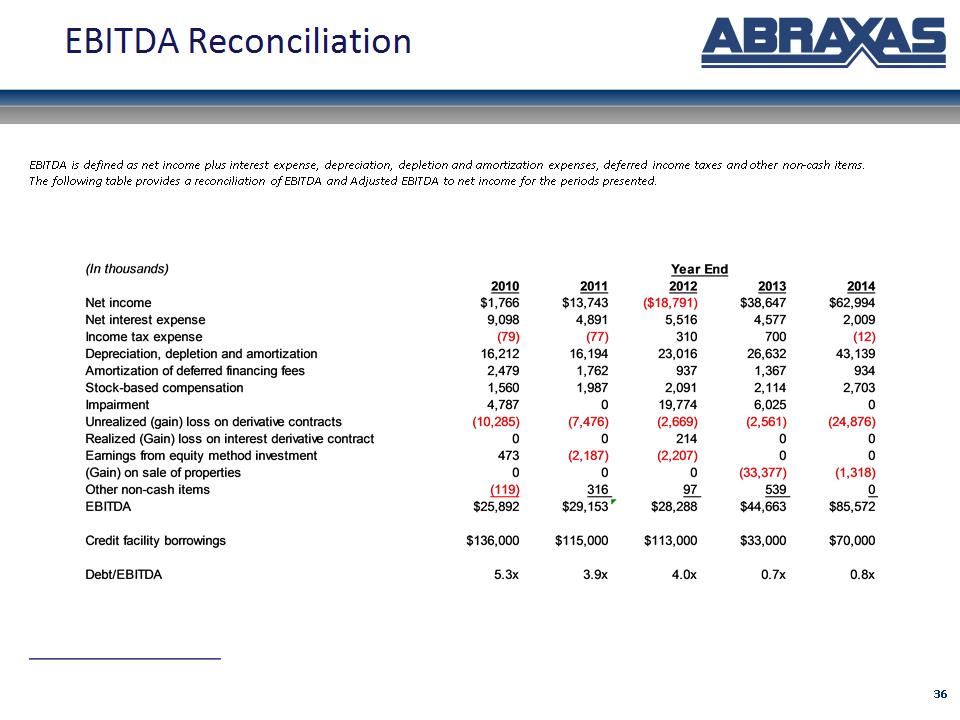

Jpmc2016idexhibit991

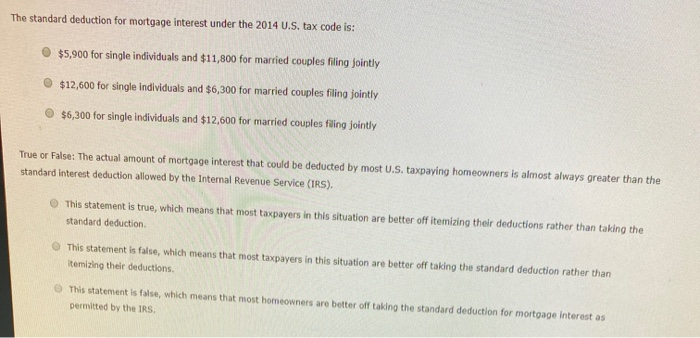

Solved The Standard Deduction For Mortgage Interest Under Chegg Com

What Is The Mortgage Interest Deduction The Motley Fool

The Home Mortgage Interest Deduction Lendingtree

Mortgage Interest Tax Deduction What You Need To Know

Mortgage Interest Deduction A Guide Rocket Mortgage

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Mortgage Interest Deduction How It Calculate Tax Savings

Felly Montessori Educational Toy From 3 4 5 Years Learning Numbers Wooden Toy Puzzle Game Learning Wooden Puzzles Motor Skills For Early Learning In Nursery For Toddlers Amazon De Toys

It S Time To Repeal The Home Mortgage Interest Deduction Niskanen Center